The Multifamily Market Is Turning — And That’s Exactly Where Real Wealth Is Built

By Vivek Kangralkar, Founder – Starcore Capital Group

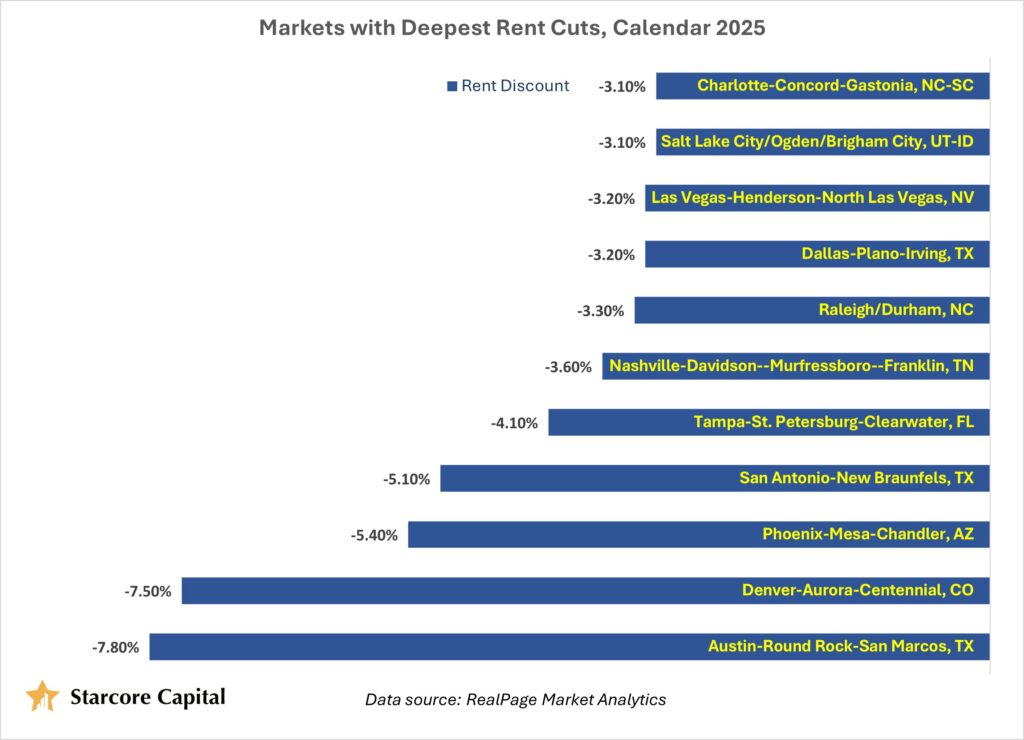

The chart you’re looking at tells a story most headlines won’t.

Across many of the hottest apartment markets in America—Austin, Phoenix, Denver, Dallas, Tampa, Nashville—rents are declining. In some metros, meaningfully so.

To some, this looks like danger.

To those who understand cycles, it looks like the early edge of opportunity.

Because real estate does not create generational wealth during the euphoric phase.

It does it during the uncomfortable one.

Why Are Rents Declining?

This moment is the result of three powerful forces colliding:

1. A Construction Wave Fueled by Free Money

From 2019 to 2022, ultra-low interest rates triggered an unprecedented multifamily construction boom. Developers could pencil deals that simply wouldn’t work in any other rate environment.

Thousands of units came online—often in the same high-growth metros.

Supply surged.

2. Demand Softened

At the same time, we’re seeing:

- Job losses and hiring freezes in key white-collar sectors

- Household formation slowing

- Renters becoming more price-sensitive

When supply rises faster than demand, pricing power disappears.

3. Owners Are Competing, Not Leading

In oversupplied markets, operators are forced into:

- Concessions

- Discounting

- Short-term leases

- Marketing spend spikes

This is where undisciplined ownership starts bleeding.

What This Means for Investors Today

For passive investors, this environment creates anxiety—and rightfully so.

Many portfolios were built on assumptions that:

- Rents always rise

- Refinancing is always available

- Time heals underwriting

That was never a strategy. It was a market condition.

Today’s reality is different:

- Cap rates are expanding

- Debt is expensive and unforgiving

- Refinancing windows have closed

- Roughly $1T+ in commercial real estate debt is maturing

Owners who relied on momentum are now exposed.

The takeaway is not “multifamily is broken.”

The takeaway is: the game has changed.

And when the game changes, who you invest with matters more than what you invest in.

What This Means for Tomorrow

Every great real estate cycle has a transfer of assets.

Not from bad people to good people.

From over-leveraged, under-operator sponsors

to

disciplined, capitalized, operationally elite operators.

That transfer is beginning.

Distress does not arrive with sirens.

It arrives quietly—through:

- Failed refinances

- Capital calls

- Burned-out sponsors

- Assets that “almost work”

This is where the next decade of wealth is formed.

But only for those prepared.

The Operator Is the Asset

In markets like this, the building doesn’t save you.

The operator does.

Great operators:

- Control expenses aggressively

- Protect occupancy

- Know their residents

- Walk their properties

- Make 100 small decisions correctly every week

- Move fast under pressure

- Don’t hide from hard seasons—they sharpen in them

Anyone can look smart in an easy market.

Hard markets reveal who actually knows how to operate.

Why We Are Leaning In, Not Pulling Back

We’ve lived this from the inside.

We bought a property in a euphoric market using bridge debt.

The market turned.

The math stopped working.

We didn’t blame rates.

We didn’t blame the economy.

We went to work.

We operated harder.

We stabilized.

We refinanced.

That experience changed how we think.

Cycles don’t punish ignorance.

They punish complacency.

This environment doesn’t scare us.

It focuses us.

Because we know what’s coming:

A window where capital meets capability.

Where those who prepared can act decisively.

Where the next generation of multifamily empires is built.

We are entering the phase of the cycle where:

- The headlines are negative

- The crowd is fearful

- Capital is hesitant

- And opportunity quietly compounds

This is not the end of multifamily.

This is the reset that creates the next class of winners.

And in this cycle, the most valuable asset is not a building.

It’s the jockey.